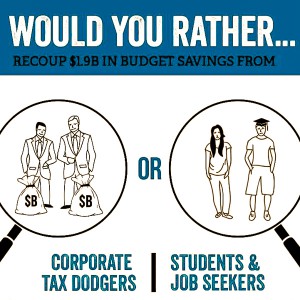

The government’s unwillingness to look at taxation management for the country via any method that involves they, that have more capacity, is quite obsessive. The decision not to proceed with tax investigation into the evasion of tax by so many large companies was a written part of the LNP Government’s budgetary papers! (Pg 117 of MYEFO Dec 2014). To facilitate this, the dismissal of 4,400 tax officials described internally as the “go to” people in the department, renders the Tax office without the resources to pursue dodgy corporate tax fraud. So Treasurer Joe Hockey then follows up with his latest tax white paper suggesting the need for a “fairer” corporate tax cut – meaning they need pay less. Given how little they already actually pay, it appears to be simply an attempt to make the disparity what the should pay and what they don’t, LESS offensive to other taxpayers. The present status being that 30% of Australian companies are paying less than 10% or no tax. So if the legal requirement for them to pay anything is being minimised further, it would be less embarrassing to the government. All of these aforementioned factors represent a gradual coverup. Add to this the recently written endorsement not to name and in fact to hide who these corporations are – it’s a huge and immediate cover-up endorsed by Joe Hockey himself.

Given that the burdens of Australian financial management still needs to be serviced by the rest of us who are forced to pay their share of the tax. Or as the last budget showed, they want to cut services to the population but would facilitate the transfer of wealth and power to the already wealthy. We only seek little things, like education, medical, social support, etc. These Tax reductions are effectively subsidising corporate Australia’s greed. Instead, we subsidise their businesses by billions, especially the mining and fossil fuel industries. The Liberal party is engaged in a massive corporate heist as they propose lowering corporate tax and continuing subsidies. The LNP have stated in writing they don’t want to collect these taxes (Page 117 MYEFO). They don’t want to modify laws to collect appropriate taxes from 30% of the countries largest companies, which by some estimates – i.e., the Tax Justice Network – it might amount to around 8.4 billion a year, and where would the Deficit the Liberal’s are so concerned about, be then? Perhaps Hockey would have to contribute even more money for the Reserve bank, to what end? Perhaps the Treasurer will buy more defective US jets, & weapons to pay for another expensively futile war which will create even more refugees for which we already pay currently anywhere between 40K to 400K/person/yr. The smaller $40,000 is for an asylum seeker to live in the community on a bridging visa. The larger $400,00 is for offshoring in Naru and Manus. It’s much cheaper to do community processing. We haven’t yet begun to pay for the metadata keeping expenses they have landed on us, running over a 3rd world speed internet.

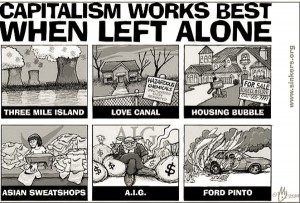

So for just how much of this corporate heist do Australian citizens want to bear witness? I am sure these companies are delighted you are both buying their products and having government pay for their subsidies. I mean what could go wrong with that? It’s capitalism. It’s just how the system works. Besides, for the most part, you don’t even know who they are. So you can’t even choose to stop your patronage of them. It’s a win for them but you…. Well, I’m sure they appreciate your continued patronage and are thinking of you. “<suckers!>”

This article was modified in early 2017 with more accurate offshore asylum costs which I had previously suggested were estimated between $40K to 1.3M along with links to supporting articles. Beyond that, it’s still sadly a relevant article as nearly every situation mentioned here has only gotten worse.