Public Fantasy

There is a public policy fantasy that nations’ budget can be compared with a business or family budget. It is mostly the Conservative’s favourite economic fallacy which they religiously promote. This myth also facilitates conservatives to argue that paying tax for the entire community’s social infrastructure and services is reckless, as the spending might add to a deficit. It creates an illusion by which they can manipulate the economic conversation. It has an emotional appeal to which families can relate. When the family budget is in trouble, their only response can be to reduce expenditure or seek to expand limited revenue capacities. The family/business budget, its debts and surpluses, limit its ability for infrastructure growth, because it does not own its currency, nor can it expand it beyond the price of its labour, savings and capital.

Business Limitations

A country’s economy, is in truth, like neither. Unlike the family or business budget where one has to mostly make more than one spends, or borrow to expand; the workings of the economy of a sovereign nation that manages its money supply is hardly as limited. Its features include:

- The ability for a government to create money, which a sovereign nation that operates its central bank can do is something which can not be emulated by businesses and families.

- A government can issue its currency to pay its debts which a family/business can not.

- A government can decide when to pay off its debts and delay the due date at its discretion, which a mortgaged family/business can not.

- A government can, from within itself, manipulate available public funds by selling bonds, for which a family/business must seek external creditors to facilitate loans.

- A government can affect the value of the currency it owes itself or others whereas a family/business is at the mercy of the changing value of money.

Zero-Sum Game

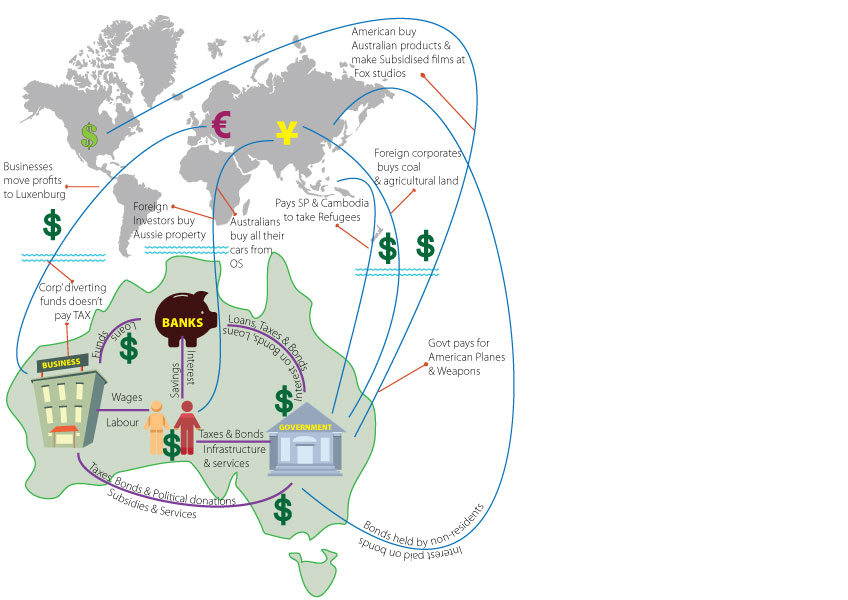

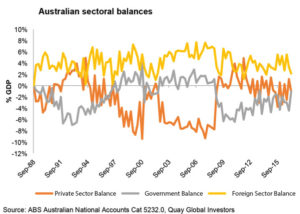

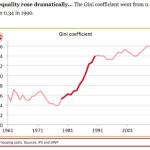

Because a government can do all these things, its budget should be evaluated on entirely different criteria to that of a family/business budget. Have a look at the diagram above. All currency that moves in an economy in accordance with the internal represents a zero-sum game for the Australian dollar. Taxes just remove money from the public but not from the economy. Interest rates can move money from and to the public (private interests), the financial organisations and the government, but NOT the economy. Spending moves money within the economy or overseas as part of the foreign debt owed in Australian dollars. The Australian monetary supply is divided between three markets – private, foreign and public entities. Some of this spending is for goods and services that are counted as national GDP, and some are called transfer payments which are not. [I will deal with transfer payments – for welfare and social services – later]. Ultimately all these money flow are fundamentally within a country’s economy.

A country’s economy, regarding the private sector balance and government balance and foreign sector balance, it is essentially a zero-sum game. As the addition of all these balances will always equal zero as illustrated by this ABS based graph. You will note that no matter the total value of a countries economy the percentage representation will always be a mirror image at any point in time.

The only four things that can change the amount or value of money in a national economy:

- inflation,

- the printing/generation of more money,

- the interest rate of money and

- the balance of payments in the export/import trade with other nations.

Evaluating an economy concerning its internal taxation and spending is a misunderstanding from which to assess an economy but one popularly promoted in an attempt to appeal to an outdated model that is nearly a century old.

Fraud or outdated?

The premise of this article is that any government conversation that evaluates indebtedness and budgeting for surpluses and deficits in the family/business framework is essentially promoting at best an outdated concept and at the worst, a fraud. The origins of this contemporary myth date back to the times when gold-backed currencies existed. Under that system, it was possible for governments to go broke because the value of the economy was limited by the value of the gold they held in reserve. But today there just aren’t any countries backed by anything so material. The ability to create money means sovereign governments simply can’t run out of money, nor go insolvent. (Assuming the country controls its currency, which is not true of the Eurozone countries – which is why Greece is in such trouble.) It’s a logic that – by all rights – ought to have been abandoned when economies ceased being backed by gold, but the conversation of conservatives continues to ignore that our monetary system can expand and has continued to do so way beyond their gold reserves. Most sovereign nation’s economies (while still maintaining gold reserves usually at single-digit percentages of their economy’s value) abandoned the gold standard as the basis of their monetary systems at some point in the late 19th to early 20th century. Many did so around World War 1 and most of the rest during World War 2. Australia did so during the great depression. No country in the world uses a gold standard for their economy, and yet this is the only basis for which deficit and surplus as an economic measure, holds any validity.

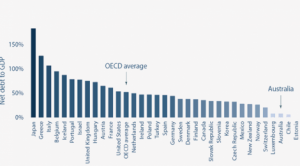

Japanese example

Japan in 2015 had a deficit of 245% of its GDP, and I visited Japan around then. They have smaller unemployment, inflation and balance of trade figures than Australia despite a far larger population, and people, strangely enough, are not running around pulling their hair out and rending their clothes in despair over the deficit. They have houses, they have jobs, and they can feed and clothe themselves. They have smaller rates of homelessness than Australia (by a factor of 10 times less despite their capital having a population larger than all of Australia) and a decent GDP growth rate of 3.2% at its best. So, what does that say about the measure of a country by its budget deficit or surplus? Just to be clear, this is the difference between all taxes (net of transfer payments) and all expenditure. It’s an only-on-paper measure of tax and spending rates for a system that is, of itself, the aforementioned zero-sum game and is essentially an inadequate measure of the health of a national economy. But it is the favourite comparative framework of conservative governments, and Joe Hockey’s budget descriptions are no exception to this rule. It also sets the perspective from which management of the economy is handled, but more on that later.

Thatcher example

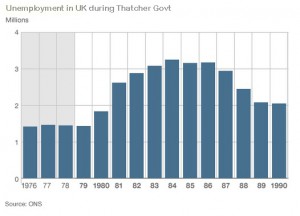

In 1979 when Thatcher came to power, Britain had a deficit, inflation in single-digit figures, industrial unrest, unemployment as high as we have it in Australia (1.3 million people in raw numbers or 12% of the workforce), a growing GDP and interest rates rising from single to double-digit figures. Thatcher cut the upper tax bracket from 83% to 60% (down to 40% when she left office). She hammered the manufacturing sector (not dissimilar to what the LNP is doing) and the mining workers, sold off public assets. Then Thatcher cut funding to local governments (not unlike what the LNP is doing to public assets and our states). Raising the VAT from 8 to 15% drove inflation as high as 21% despite her party pleading for her not to. The result was an acceleration of the economic divide between the wealthy and the impoverished. The GDP growth dropped, interest rates climbed, housing became less affordable. She tried to manage this significant effect by a “right-to-buy” scheme allowing the sale of council houses, but this led to a chronic shortage of social housing and prices continued to rise. Unemployment skyrocketed to 3 million. But by 1988 she had recorded a surplus. By then inflation was hovering around 5% (although it later rose again), unemployment was still high at 2.5M, GDP growth was strong (although coal production, oddly, was falling) and interest rates which had been fluctuating around 10% began rising again.

But Britain had a surplus! The rich grew more affluent, and the poor became more miserable. The lack of social housing, astronomical like the unemployment levels, etc.in, all of which meant crime increased 79%. Social upheaval ruled the waves, where once Britannia stood. As Alex Nuns pointed out: “Between 1980 and 1983, capacity in British industry fell by 24 percent. Unemployment shot up, eventually topping 3 million. Thatcher effectively shut down British manufacturing, much of it forever. In its place, she turned to the banks and the City, making their wildest dreams come true with the financial ‘Big Bang’. We know how that ended. ” So perhaps deficits and surpluses are not a measure of anything other than a hankering to the days of the previous century when gold backed our currency, and old-fashioned notions of how economies worked were in vogue.

The Reserve Bank

The Reserve Bank of Australia serves the government to both controls the supply of money in the economy and advise of how much money is in circulation through the commercial banking system. The Government also controls the supply of money through taxation and the sale of bonds which removes money from the marketplace. In the private sector, withdrawing money from the market is accomplished through personal savings and import payments. How well the Reserve Bank of Australia calculates and manages the balance of money in the economy is, admittedly, a juggling act. The Reserve Bank may raise interest rates to soak up and remove money from the economy, or to do the reverse to provide more accessibility to money for the private purse. Which it does is sometimes a calculated gamble. The Government’s issuing of bonds achieves a similar role in the economy. From this perspective taxation does not fund spending, it just withdraws existing money in the economy from the private purse into the public one. Remember the government can create the money it needs by printing or electronically generating it, should it need more, than what is in the public purse. It merely alters numbers in a computer to move money electronically into the accounts of financial institutions. The Government and Reserve Bank’s responsibility regarding the economy is to maintain a balance of money in an economy, like water in a tank. This analogy is well explained in John Kelly’s article “The ridiculous debt and deficit scam”, so read it if you are not following this so far.

The meanings of Deficits and Surpluses

Upsetting the balance in the tank does not create debt or surplus. That is primarily a fiction created by the conversation perpetuated by the likes of Joe Hockey and our Conservative government. A budget that shows more money spent than is collected in tax may represent a deficit, or where less money spent then is acquired through income tax, demonstrate a surplus, but that is only on an accounting paper. Its real impact on an economy is negligible except as a guide for determining how to influence that deficit or reduce the surplus by:

- removing money through the selling of bonds

- increasing taxation

- reducing expenditure

- printing more money provided inflation is appropriately managed

Deficits and surpluses exist as a stepping stone for making economic decisions, not a “be all and end all” goal in themselves; the way Hockey talks about them. Put simply, a government that creates a surplus has in effect removed more money from the private sector economy than it should have. The Government is not a business; it is not there to make a profit, it is there to provide services, redistribute wealth, manage what public utilities it hasn’t sold off, fund infrastructure and develop a stable economy. The reality is that this deficit or surplus money doesn’t exist, except on a paper budget. The measurement of a deficit/surplus is a tool for management of the economy not an outcome in itself, but this is not the way it’s presented. The Government rhetoric about the deficit and unsustainable spending and the mess of the Labor Government is simply a fiction. It is misleading the public into treating Australia as if it were a large household with a limited financial capacity and finite income backed by some “gold standard” value. The reality is we abandoned that model nearly a century ago at the onset of the great depression.

But, But, But, …. what if it is a good measure?

Even if we were to assume that the Government budgetary balance of payments was a good indicator of a government’s performance, then the Government’s doubling of the deficit since being in office would suggest the evidence was that they were failing at the job. Given that the current Liberal government has accumulated debt at a rate of $2B / week since they were elected if the deficit/surplus measure is supposed to be a great indicator of “adult” governance, then you would have to say by that criterion alone the LNP government are a colossal failure. So, even if you do want to hold to the fantasy of deficits and surpluses as indicators of an economies health, you would have to conclude that the current situation is practically beyond redeemable logically. Except it’s not.

Balancing the Water Tank

Printing money excessively may generate inflation so upsetting the balance in the financial “tank” does have an impact on the economy through inflation. A sovereign nation with its currency can’t face insolvency issues, but it does have to manage the issues of inflation, the balance of payments and employment. Their proper role, (in theory although not in practice) is to distribute the sum of money is in circulation in the economy and remove or add money from the available pool to exercise control over economic impacts such as inflation and employment. To quote John Kelly’s article, “The objective is to maintain as close as possible a constant level of money in our economy; enough money in circulation sufficient to avoid inflation which is what happens when there is too much money in circulation and recession when it is too little.” This is what Governments should be focusing on if they are either economically responsible or financially literate.

Inflation

Inflation results in higher rates of interest, reduced incentives to save as your money’s purchasing power diminishes. It reduces your return on investment and currently threatens economic stability in a country. While written a long time ago, P.D. Jonson’s article on “inflation its costs its causes, and it’s cure” makes for an interesting analysis of its effect. The role of government is to levy taxes not to raise revenue to spend but to manage inflation, redistribute income and affect market pricing. The statement from any individual that suggests that the taxpayer is funding government spending, while a common misconception, it only reflects the near universal misunderstanding of how the monetary system’s tax policy works in an era that has long left behind backing any economy according to the old gold standard.

Interestingly although, this is the conversation and the misconception mainly promoted by the Government which either reflects a lack of understanding of the economics of a country as opposed to business; or is, in fact, a deception designed to misdirect the public from the realities of how the economy should be managed. Tax in this conversation is about reward and punishment for groups and businesses. It becomes not about equitable income redistribution and inflation management but about managing political dissent or acquiesce through rewarding or punishing bodies via taxes and subsidies. It becomes about the irresponsible management of an economy. The efforts to punish the economically disadvantaged and yet subsidise by billions the LNP support base inherent in Hockey’s 2014 and 2015 budget reflect this inherent economic mismanagement.

Why Spend money

Returning this conversation, to the subject of spending. Unlike the money I might spend on a sports car, (where one can pretty much assume a continued expense draining one’s income) government spending generates economic activity! $$$! When the government spends money on infrastructure, be that for a hospital, roads, rail, education, classrooms, et cetera, the money invested in generating the employment for their building or use will generate wealth in the private sector. Taxes whether that be GST on materials or income tax from the people employed ensures the money circulates and through transfer payments reduces inequality.

Conversely when the government decides to cut a program — which we have seen a lot of during Abbot’s government — then people are unemployed, and poverty and inequality expand. The compensatory effect often leads to the need for increased transfer payments by the government. Hence the rising disparity between tax and spending at the average rate of $2B / week as previously mentioned.

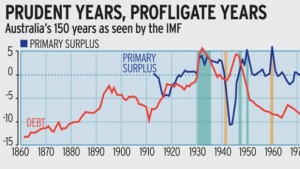

Howard Spendthrift!!

Such was the case in the Howard years – denied by him of course – which the IMF noted was one of Australia’s largest spending sprees. The International monetary fund examined 55 leading economies and 200 years worth of government financial records to identify what it considered two periods in the Australian history which it described as “fiscal profligacy”. These were in 2003 at the start of the mining boom and in Howard’s final years of office between 2005 and 2007. Howard was fortunate to have governed during a period of macroeconomic conditions internally and abroad, which the Labor government that followed did not have. If you want to read more about that have a look at Ross Gittens Sydney morning Herald article or Steve Keen’s article in Business Spectator.

Many economists suggested that what Australia had, was no longer a spending problem but revenue problem as taxes were seen as revenue for an economy not a balancing between private, foreign and government balances. These comments were quickly sidelined as neither major political party wants to be blamed for raising taxes, although both the carbon and mining taxes were instituted under the Labor Government.

Why generate revenue

Hockey’s removal of both of these taxes removed billions from the budget, as did the 8.8 Billion he provided to the Reserve Bank upon the Coalition gaining government. These were significant withdrawals from the “tank” of money available to the economy. While it is correct the Mining Tax was hampered by an overburdening administrative cost, instead of fixing the administration issues, and therefore reaping the billions in benefits to the budget bottom line; Hockey chooses to eliminate the potential movement of money and subsequent controls on industrial pollution. Despite it being regularly raised, the LNP continued the billions in their expenditure by way of subsidies to mining companies that they are not in dire need of (but which does enable them to produce “super profits” which the government no longer taxes). With these generous “welfare” payouts to a mining industry that only employs a mere 2% of the population, it makes the much-maligned return of $882 million in paid taxes to Murdock’s Newspapers look like chicken feed. What does look like “chicken feed” is the transfer payments from this government to their recipients? For some reason, the government calls that “welfare” but does not prefer the term “welfare” when contributing billions to big business. Add to this the reluctance of the government to collect the taxes of 30% of Australia’s largest corporations, which by operating through tax havens pay a minimum tax rate. Senate inquiries into this largess on the part of the government have failed to generate any change. Australia however you look at it, does not have an expenditure issue, it has a revenue issue – it doesn’t seem to want any.

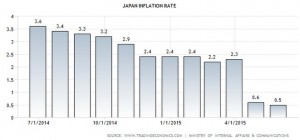

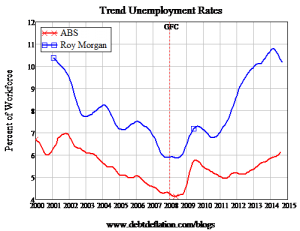

With increasingly less money in the “public pool” as the expenditure cut grew and little of it being poured into infrastructure projects, there was an initial boost in inflation following these events. Inflation went as high as 3% in 2014. In 2015 inflation has averaged about 2.3%. And while inflation has fallen in recent times so has consumer discretionary demand which has generated downward pressure on prices. The drop in business confidence is also a factor in the changing value of the dollar. Factor in the mostly greater than 10% unemployment (see Roy Morgan stats, not the Government’s) since the Coalition has been in power and you will realise the “pool in the tank” is diminished as personal savings rise to whether the absence of discretionary income and harsh welfare cut proposals. Essentially, it is not the simplistic and much maligned “deficit/surplus” accounting indicator that is at play, but a combination of other factors that guide the health of an economy.

Employment

Employment in an economy is a better indicator of an economy’s health. Full employment (or as close as you can get to it) means the people in that economy are contributing to the growth of that economy. If a sovereign government – in an attempts to repay the paper debt (as would only be necessitated under the old gold-backed economies) – decides to be raising taxes or cutting expenditure, then this is likely to cause higher unemployment. Unemployment is a measure of the spare capacity of an economy. Where there is excessive unemployment, it is evident that there is a need for targeted government expenditure on infrastructure to generate the work and consequential rise in the government coffers through taxation. The apparent restriction on infrastructure spending to maintain low levels of unemployment is only to manage the levels of inflation inherent in that economy. So any given government can support low unemployment levels provided their expenditure does not affect national inflation rates. This is a far better measure of use of expenditure capacity than that of taxes, spending and borrowing. Government removing money from the economy by bonds and taxes and reducing expenditure to achieve a surplus in effect removes money from the private sector and possibly affect employment resources. Although a government involved in employment where there are unused labour resources, through spending on people, can lower unemployment and inflation simultaneously.

Meanwhile back in Australia

Australia’s economy is in reality falling, faced with lower commodity pricing and consequently prices falling inflation and rising unemployment. Inflation has dropped from 2014 to 2015, and even Joe Hockey’s 2015 budget predicts further rising unemployment. This is an economic environment in which the government should be creating money (without borrowing) to spend to improve infrastructure and services and finance our productivity to provide for a better future for Australians. Instead, it is hellbent on cutting expenditure in areas where productivity expansion is sorely needed and oddly enough, revenue ( mining and carbon taxes), and yet it is still generating a larger deficit on paper. Roy Morgan statistics ( far more accurate than the ABS stats) demonstrate we have over 10% unemployment, a ratio of jobs to unemployed of 1:8 (157K jobs Australia wide verses 1,309K unemployed) and while inflation in 2014 went as high as 3.0%, it has been steadily dropping and was at 1.3% in March 2015.

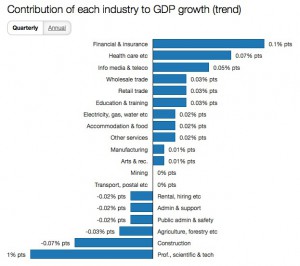

The economy is ripe for an approach incorporating massive targeted government expenditure, a decrease in financial inequality via taxes to the higher end of the market, and a reduction in subsidies to markets that employ decreasing numbers of Australians. For example, Mining which contributed nothing/zero/zip/nada to economic growth in the Dec 2014 quarter – dropping down from 5.6% in 6 mths. Mining has decreased its employment of Australians down to 2% of the workforce. So the LNP reduces accountability to Finance, cuts Healthcare, increases costs to Telcos to keep our metadata, cut public broadcasting, seeks to undercut education, privatises and therefore increases costs for power, kills off manufacturing industries and has already cut CSIRO and other scientific research. All of which, as you can see from the diagram here, are the growth markets for our economy. There isn’t a single growth industry the LNP government hasn’t undercut. And before you point out that Scientific research wasn’t one of them as professional/scientific/technical contracted by 1%, that figure in the diagram is a result of damage already done, as it used to contribute 145 billion to our economy each year. {And before you note I haven’t mentioned Arts and recreation, … seriously .. George Brandis’s portfolio … the LNP who have policies on their website for everything except the Arts … The Liberal’s support for the Arts? … do you even have to ask? If you think I need to answer that, you need to stop reading now because you are not going to follow this at all. …} But we subsidise a non-contributor like Mining to the tune of billions. As jobs were disappeared from mining, the expected pickup in Construction did not occur and had begun falling. In short, the current economic course being chartered by the budgets of Joe Hockey and company is one that will result in greater inequality, less employment and a decreasing growth of our economy.

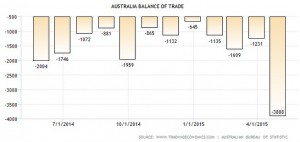

Balance of Payments

Australia’s balance of payments figures has worsened in the last year extensively. The drop in the value of commodity exports and rising capital imports. Our reported trade deficit (as seen in the graph) is $3.89 billion. This is where the zero-sum game – I alluded to before – has a significant “leak”. Something has to either the private or government sector. If you flick back to my diagram at the head of this article, these leaks are referenced by the blue arrows/lines. You will note I have referenced some specifics by way of examples that have been in the media as of late. While indeed the drop in the value of commodities is beyond the government’s control, other actions by the private sector are well within the government’s purview. Australian companies redirecting profits overseas and not paying taxes due in Australia are examples of billions of dollars being leaked out of the country and reducing the pool of money available to the Australian economy. This is essentially corporate theft on a grand scale. This is not the only area where financial leakage is well within the scope of the government’s control. In this respect, rather than outline all the sectors – and make this article even longer than it is [you’ve stopped reading haven’t you] – I will simply suggest you review the illustration above and do your background research.

Valid Indicators

So if “deficit or surplus” are not indicators of the health of the economy, what is? Obviously so far in this line of thought, inflation is one indicator, as you will find is: Australia’s continued AAA credit rating maintenance throughout the global financial crisis, its economic growth in terms of GDP, employment growth or unemployment growth, low or high-interest rates, productivity growth or loss, good/bad terms of trade, business confidence or anxiety. Consider also how we should be evaluating how to manage a national economy as a series of balancing and distributing the money presently in an economy to facilitate low inflation, high employment and equitable levels of import and export. All of that being opposed to using the national economy as a “carrot and stick” metaphor to reward or punish elements of the society that support or condemn a particular political system. Now try evaluating the Australian economy according to appropriate 21st-century criteria (rather than a “golden” oldie 19th/early 20th century one) and a very different picture begins to emerge. If these are the “economically responsible adults” in charge of our Nation …. God help us.