Executive Summary

This National Electricity Market (NEM) is being supplied with an increasing amount of intermittent power. The current market structure was implemented in the 1990s and was based upon the market being supplied by scheduled generators, typically in the form of large coal-fired power stations. Since that time there have been two key developments, the rapid fall in the cost of intermittent generation in the form of wind turbines and solar PV as well as an implied desire by society to reduce anthropogenic greenhouse gas emissions. This has resulted in an increase in the amount of intermittent generation supplying the NEM. Since the NEM was designed on the assumption that the generators would be scheduled generators, the introduction of an ever-increasing amount of intermittent generation has started to stretch the capability of the NEM to absorb more intermittent generation.

The solution outlined in this paper is to establish another market operated by AEMO in parallel to the scheduled generation market that would be a scheduled load market. The scheduled load market is a market that is designed to operate with intermittent generation. The key operational difference between the existing scheduled generation market and the proposed scheduled load market is that in scheduled generation market the generation output follows the load while in a scheduled load market the amount of power consumed by the loads follows the amount of power being generated by the intermittent generators.

The technology to support a scheduled load market is now relatively mature, with new developments in communications technology (5G M2M) lowering the cost of introducing a scheduled load market.

A key advantage of a scheduled load market is that it gives electricity consumers the option of purchasing electricity at a lower price than the standard scheduled generation type of power that they currently purchase. Other solutions to the issue of intermittent generation can require consumers to pay more for the electricity that they consume.

Power supplied from a scheduled load market can be subsequently used by energy storage facilities to supply the scheduled generation market. Power from such facilities should significantly improve the stability and reliability of supply for the scheduled generation market even when there is substantial penetration of intermittent generation in the NEM supply mix.

The proposed scheduled load market should not be confused with the ability that some large loads currently have to bid their load into the scheduled generation market. These bids are into the scheduled generation market that was established for scheduled generation. Load bids into the scheduled generation market are very rare as there is rarely a situation where an economic benefit can be derived from such a bid. These bids are not related to intermittent generation. The proposed scheduled load market is only supplied by intermittent or non-scheduled generation.

Overview

A traditional electricity supply system that has a large amount of intermittent generation requires either energy storage (pumped hydro, batteries) or fast responding generation on standby (i.e. gas turbines) to cover the periods when the intermittent generation is not producing power. Either way, the solution is relatively expensive in terms of cost per kWh, which adds a considerable amount of cost to the basic intermittent generation cost. An alternative to the energy storage or quick response solutions is the inclusion of a scheduled load market in the National Electricity Market. (Operated by Australian Energy Market Operator but separate from the existing scheduled generation market).

A scheduled load market uses advanced technology combined with an efficient market to deliver a low-cost solution that incorporates intermittent generation into the electricity supply system.

Background

Intermittent generation creates issues with system stability as the level of intermittent generation rises relative to the level of scheduled generation in an electricity market such as the Australian National Electricity Market (NEM) that has historically been supplied with scheduled generation. Scheduled generation is the generation that can be controlled by scheduling its output to a specified level as well as a ramp rate up or down as required to meet the system load demand. Examples of scheduled generation are steam turbine generators and hydroelectric generators. Examples of intermittent generation are wind turbines and solar photo voltaic generation.

In the current scheduled generation market, the output of scheduled generation is continuously adjusted (on a five-minute basis) to match both the load demand and the variation in output from intermittent generation. The Australian Energy Market Operator (AEMO) is the NEM operator. AEMO has mitigated some of the control issue related to intermittent generation by classifying large intermittent generators as semi-scheduled generators. Semi-scheduled generators are required to supply AEMO with short-term generation forecasts. To some extent, his helps AEMO control the scheduled generators to maintain the system in the balance between the energy generated and the energy consumed by the loads (system stability). However, this only results in a modest improvement to system stability and does not resolve the longer-term issue of reduced system stability and power availability associated with increasing levels of intermittent generation.

The NEM physical infrastructure consists of three primary components, these being the generators, the networks and the loads. Typical loads are industrial, commercial and residential. In the current NEM, AEMO controls the output of the scheduled generators to match the demand of the loads and the variations introduced to the system by intermittent generation. Before the growth of an intermittent generation, AEMO only needed to match the output of the scheduled generators with the demand of the loads.

Summary of solution to the security and reliability issues due to intermittent generation

The existing electricity market was designed before the advent of intermittent generation as a source of electricity supply. It operates by having the generation output follow the load demand. Intermittent generation by its nature is not capable of following the load demand and so does not meet the requirements to be classified as scheduled generation.

To address the issue of system control as well as signal the real market value of intermittent generation, this paper proposes the addition of a scheduled load market to the NEM to operate in conjunction with existing scheduled generation market.

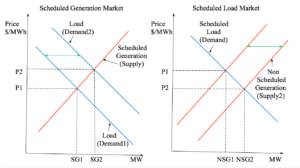

In simple terms, the difference between a scheduled generation market and a scheduled load market is that in a scheduled generation market the generation output follows the load, while in a scheduled load market, the load follows the available intermittent generation output. The details of a scheduled load market and how it could work in conjunction with the existing scheduled generation market are detailed in following sections.

A summary of the key consequences of introducing a scheduled load market are given below

- Scheduled load market consumption follows the output of intermittent generation. Variation in the output of intermittent generation is reflected in the scheduled load market price.

- The price that scheduled loads would pay for intermittent power is significantly less than the price of scheduled generation power. This reflects the difference in the market value of scheduled generation and intermittent generation.

- Scheduled loads are not limited to conventional electricity consumers such as industrial, commercial and residential loads, but would also include loads associated with the scheduled generation that have a storage capability. Existing examples of scheduled loads are hot water tanks; pool filter pumps with electric car chargers and cold storage systems also being possible scheduled loads.

- Since the initial scheduled load market demand is likely to be low relative to the existing installed intermittent generation capacity, the initial price for the energy component of scheduled load electricity is likely to be close to zero. The initial very low price of scheduled load market energy would stimulate the uptake of scheduled load and thus increase the amount of scheduled load in the NEM.

The characteristics of a Scheduled Load Market scheduled load

In a scheduled load market a scheduled load is a load that does not require electrical power on demand for the power to be useful for the consumer. An example of a load that could typically be a scheduled load is storage hot water heating, while an example of a load that would not be a scheduled load is house lighting. The storage hot water heating could either be in the form of electric-only hot water systems or as an electrical boost for solar hot water systems. The charging of electric cars is a load that could also be a scheduled load.

The electricity networks have operated ripple based controlled load control systems in Australia for almost sixty years. The ripple system remotely controls contactors on a consumer’s switchboard, switching the controlled loads on and off. This control load service has been primarily used for hot water loads and is frequently referred to being an Off-Peak service, which is misleading since it is more than a contactor that connects and disconnects a load. The network ripple based controlled loads service switches loads that are connected to a distribution centre transformer in a sequence to avoid overloading the distribution mains. An arrangement that had a similar effect would be required for a scheduled load market. (It may be possible to use the existing Transmission Node Identity (TNI) associated with each National Metering Identifier (NMI) to sequence loads to avoid overloads in the distribution system when operating a scheduled load market. If this does not allow for adequate sequencing intervals, then each NMI’s distribution mains identity would also be required).

Water heaters and electric cars are examples of scheduled market loads that can be either residential or commercial loads. Industrial loads could also be scheduled loads if the industrial process does not require power on demand.

Another possible type of scheduled market load is an energy storage type of load that could operate as a source of scheduled generation. Examples would be pumped hydroelectric or commercial battery facilities. Such facilities could purchase energy in the scheduled load market and sell energy as a scheduled generator into the scheduled generation market with the price differential financing the capital cost of the facility. This would effectively convert intermittent generation into scheduled generation.

Scheduled load market operation

A scheduled load market is similar in operation to the existing scheduled generation market with the differences between a scheduled generation and a scheduled load market identified below along with the issues intermittent generation creates in the operation of a scheduled generation market.

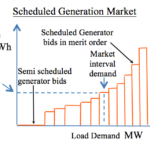

In Australia, AEMO is responsible for operating the scheduled generation market. AEMO does this by sending dispatch orders (via telecommunication systems) to scheduled generators based upon their merit order position (which is based upon their bid price) and transmission network constraints. The merit order for scheduled generators is primarily determined for every market time interval based upon the scheduled generator’s bids for each market time interval. A scheduled generator which is higher in the merit order may not receive a dispatch request from AEMO due to a transmission constraint, so the dispatch request is sent to the scheduled generator that is next in merit order that does not have a transmission constraint. Semi scheduled generators (intermittent) typically bid at zero $/MWh and so are usually the first in the merit order of dispatch with only transmission constraints limiting their output. The difference between the total load demand and the intermittent generator’s output is supplied by the scheduled generators.

Scheduled generators receive both generation level and ramp rate dispatch orders from AEMO. AEMO does this to balance as closely as possible the system load demand with the scheduled and intermittent generation supply. AEMO sends updates in ramp rates to the operating scheduled generators every 5 minutes. As the difference between the load demand and the intermittent generation output shrinks with increasing penetration of intermittent generation, it becomes progressively more difficult to use scheduled generation to meet the difference between the total load demand and the output of the intermittent generation. The factors, which cause this to happen, are the lumpiness of the minimum output levels of scheduled generators, the limits on the ramp rates of the scheduled generators and the possible rapid changes in the output of the intermittent generators. The normal changes in load demand can combine with changes in the output of intermittent generation to result in the required ramp rates for the scheduled generators to be increased to a level that is greater than what the scheduled generators are capable of meeting. The final issue with increased penetration of intermittent generation is that it cannot be relied upon to meet the needs of loads that require scheduled generation. Since the price of intermittent generation is currently the same as scheduled generation, there is presently a very small financial incentive to use intermittent generation to supply power to storage type loads (such a pumped hydro or batteries) which can be used as sources of scheduled generation.

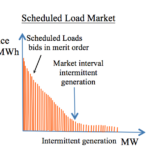

The scheduled load market would be operated by AEMO. It would operate by AEMO sending dispatch orders to scheduled loads based upon their position in the order of merit with transmission constraints included in the dispatch process. This would use a similar (if not the same) communications system as dispatch orders to scheduled generators. A key difference between a scheduled generation market and a scheduled load market is that in a scheduled generation market the lowest bid price is first in the merit order with the sequential position of the other generators in the merit order based upon their bid price, while in the scheduled load market the highest bid price is first in merit order with the sequential position of the other scheduled loads in the merit order based upon their bid price.

In the current scheduled generator market, only large generators are required to be scheduled generators, and these generators are also required to have specified generation ramping capability that can be adjusted at 5-minute intervals by dispatch commands from AEMO. In a scheduled load market, there would be many small loads which would not have consumption ramping capability. However, large industrial type scheduled loads would be required to have five-minute update intervals as per the scheduled generators. The bidding in the scheduled load market would not be as dynamic as the bidding in the scheduled generation market as the position of a load in the merit order would also be dependent upon distribution factors. In reality, one would expect that most small scheduled load consumers would tend to set and forget their scheduled load bid price. Since there would be a large number of small scheduled loads, each scheduled load consumer would have to fit into the available merit order price slot closest to their bid price. (Very small price intervals increments would achieve this).

Another key difference between the scheduled generation market and the scheduled load market is that in the scheduled generation market a generator is expected to be able to meet dispatch requests from AEMO. In the scheduled load market, there would not be a requirement for small scheduled loads to meet dispatch requests. Large scheduled loads (typically industrial type scheduled loads) would be expected to meet dispatch requests as well as having specified load ramping rates.

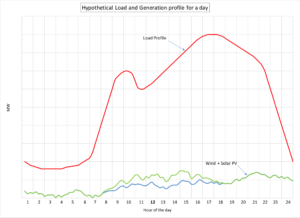

The following chart shows how the current scheduled generation market operates on a hypothetical day.

In the above chart, the red line shows how the load demand and hence the total generation varies over the day with relatively low levels of intermittent generation. The green line shows the total of the wind and solar PV generation (i.e. intermittent generation) while the blue line shows only the wind generation during daylight hours. The difference between the red line and the green line is provided by scheduled generation.

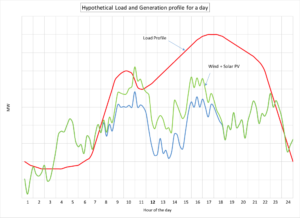

If higher levels of intermittent generation are introduced into the scheduled load market, then the difference between the load demand and the intermittent generation can become problematic at the level of the intermittent generation which in energy generated terms is significantly less than 100% of the total energy generated.

This is illustrated in the following chart. Under the current market arrangements, there would be a period where the intermittent generation exceeded the load demand. This type of problem can be rectified by the output from the intermittent generators being curtailed. However, this results in increasing the cost per kWh of the energy generated by the intermittent generators. The ramp rates for the scheduled generators are very high in the scenario, and they may not be able to operate with high enough ramp rates to meet the requirements of the market loads. The stability of the network may be difficult to maintain with such rapid swings in the difference between the load demand and the intermittent generation output.

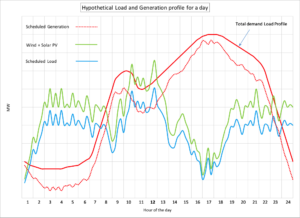

If a scheduled load market was introduced, then the following is an example of how the generation could meet the load demand over a typical day. The chart below shows a fairly extreme situation where the wind generated at night is exceeding the schedule generation market load demand, and the daytime intermittent generation is relatively low due to clouds and low wind generation during the particular day. The presence of a scheduled load market absorbs the large swings in an intermittent generation so that the scheduled generation does not have to be rapidly ramped up or down as shown by the dotted red line.

Some of the energy absorbed by the scheduled load market could be used in energy storage facilities such as pumped hydro or batteries which can then be used to supply the scheduled generation market with the price difference between the two markets funding the capital cost of the energy storage facilities.

The final key difference between the scheduled load market and the scheduled generation market is that the price for paid for energy consumed by the scheduled loads would be their bid price. While in the scheduled generation market the bid price by the last generator dispatched in the merit order is paid to all scheduled generators which is then the wholesale price for the market interval.

The reasons for this type of pricing approach is that it gives certainty to load consumers as to the price that they pay for scheduled load power and that scheduled load is typically optional which is not the case for scheduled generation bids.

The differences between the market interval bidding prices for the two markets are shown below. Note that the price scales are different.

The intermittent generation not sold through the scheduled load market would be sold through the existing scheduled generation market at the scheduled generation price. AEMO would not target all of the intermittent generation for use in the scheduled load market; it would target a portion of the intermittent generation based upon the price in the scheduled generation market. It could be a simple linear inverse relationship or possibly a more complex relationship if that were found to be necessary. The key point is that when the price of electricity in the scheduled market was high, then AEMO would only target a small amount (and perhaps zero) of the output of intermittent generation for the scheduled load market. An example of such a control relationship is given below.

Let

P = Percentage of intermittent generation available for the scheduled generation market

S = Scheduled generation price ($/MWh)

- P = 100 – S/500

This relationship would be valid up to the $500/MWh level. ($500/MWh used for example purposes). Above the $500/MWh, all of the intermittent generation would be available to the scheduled generation market.

The storage type scheduled loads would likely use the opportunity of high prices in the scheduled generation market to sell the stored energy that they had previously purchased at a much lower price through the scheduled load market.

A schedule load market does not currently exist. Establishing a small pilot of a schedule load market would be the best way to develop the larger market. It is likely that retailers would be used to sell the solution to customers in such a pilot. If retailers were reluctant to participate in such a trial, a possible alternative would be to approach aggregators who could then approach customers independently of retailers.

The following two charts demonstrate the difference between a scheduled generation market and a scheduled load market.

Elements of a scheduled load market

The current players in the Australian electricity market would have the following roles.

Consumer loads – Requests a scheduled load price from their retailer and have the required equipment installed in their switchboard to service an approved load.

Retailer – Submits scheduled load prices and sizes for each NMI to AEMO.

Networks – In addition to the TNI data they would also supply distribution mains data for each NMI to AEMO. A unique distribution mains identifier for each distribution mains phase may also be required.

AEMO – Determines the order of merit and schedule load price for each scheduled load. Operates the scheduled load market through dispatch signals and meter data from scheduled loads. Calculates each market interval price for intermittent generation energy sold through the scheduled load market.

Metering – Interval meters with remote communications and integrated contactors would be required for scheduled load market load circuits. The general supply metering could remain the same. However, the M2M communications solution used for the scheduled load service could also be used to send the general supply metering data back to the market participants.

Communication – A low cost, ubiquitous and secure M2M communications solution would be required for a scheduled load market to be implemented.

Consequences of introducing a scheduled load market

The introduction of a scheduled load market for an intermittent generation would be a gradual process with a trial being the preferred initial approach to eliminate any bugs before a full rollout. The initial scheduled load price would be very low (the energy component of the consumer’s scheduled load price would effectively be zero for consumers given the current large and rapidly growing supply of intermittent generation) which would spur the uptake of the scheduled load service. The scheduled load service would eventually replace the existing controlled load service currently operated by networks. Since the initial amount of energy sold through the scheduled load market is initially going to be small, the impact on the average price that intermittent generators would receive for the power that they generate would initially be small as well. However, as the market for scheduled load expanded, the average price that intermittent generators received for the energy that they generated would fall, potentially to a value significantly less than that received by scheduled generators. This difference in price would effectively indicate the difference in value between intermittent power and scheduled power. Since the cost of intermittent generation has fallen over time and is expected to continue to fall (in real terms) the long-term lower price for electricity generated via intermittent generation should not be a significant issue for intermittent generators.

The electricity consumer would benefit from the wholesale price in the scheduled generation market having a low soft ceiling due to the presence of a large amount of intermittent generation as well as the consumer having access to low cost scheduled load electrical energy.

—-//—-

Glossary

AEMO – Australian Energy Market Operator

Intermittent Generator (Non-scheduled generation) – A description of a generator whose output is not readily predictable, including, without limitation, solar generators, wave turbine generators, wind turbine generators and hydro-generators without any material storage capability

Scheduled Generation – Electrical generation that can be controlled to a specified output level and output ramp up/down. AEMO must be notified of the availability of each scheduled generator for each scheduled market trading interval. A scheduled generator may submit dispatch offers (i.e. bids) for each trading interval.

Scheduled Load – In the existing scheduled generation market a load that can be dispatched into the market. In a Scheduled Load Market, a scheduled load dispatch is directly linked to intermittent generation output.

Semi-scheduled generation – AEMO classifies a generator as being semi-scheduled if its output is intermittent and has a nameplate rating exceeding 30 MW.