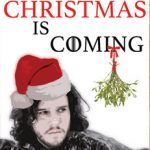

Winter is coming!

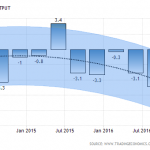

This winter was cold apparently, and Australia slipped on the ice. No limbs were broken in the fall, but the economic dilatometer for Australia’s GDP has demonstrated contraction. Not a surprise when you consider a full range of economic indicators for the Abbott/Turnbull Government. The September quarter revealed a .5% shrinkage in our GDP, not seen since the Queensland flood affected the March 2011 quarter. The time before that was during the Global Financial Crisis. It has not been an unexpected fall given the low growth figures each of the last year’s quarters. In June 2015 quarter it was our accounting standards that defer payment recordings that recognised a 41.5% jump in government defence spending that secured a tiny growth rate. There was no defence spending finalised to save us in September 2016.

Will the Wall hold?

The Coalition team were quick to allay fears of recession, as was the media. The Treasurer blamed the deterioration on the lack of opportunity to provide tax cuts for corporations. The same corporations that by in large provide little to no tax revenue to our bounty and often relocate locally generated profits overseas. On the radio, Christopher Pyne blamed poor performance on the distraction of Australian and American elections but commented that now these were over, things would be better. What?

Build your walls higher!

The largest contributor to the fall in GDP growth according to the Australian National Accounts was the reduced output of the construction industry. Construction work had continued to tumble for the 3rd consecutive quarter taking its biggest fall of 4.9% in September’s quarter. Some are blaming poor weather (i.e. rainfall ) for a fall in building activity. Aside from the fact that we are now in the wet monsoon season meaning things will get worse, is the industry suggesting “construction” doesn’t make allowances for rain? To be fair, the Bureau of Meteorology had been reporting higher rainfalls than normal for July thru September, but it has also reported a long term decline in rainfall of around 11 per cent since the mid-1990s in April–October in the continental southeast and 19% in the southwest of Australia. Forgive me the pun, but does rainfall as an excuse, hold water? Might there be other factors in the construction downfall?

Letting “investments” through the gates.

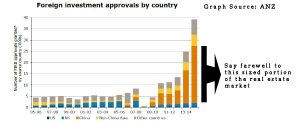

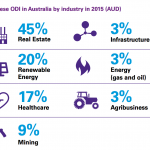

An August News article showed foreign investment approvals had shown a sharp increase in Chinese nationals particularly in the last few years. Now the previous linked News article suggested the tightening of bank lending was unlikely to affect Chinese enthusiasm for Australian real estate adversely. But is this true? Concerns about Chinese investors laundering money in the Australian housing market was exposed by the Four Corners program “The Great Wall of Money” in late 2015. Three significant events occurred in the period after this program went to air.

- Despite much procrastination because of the economic risks to the banking system, the prudential regulator of banks, APRA began to enforce some of their own rules on high-risk lending.

- Australian Banks uncovered evidence of numerous and sophisticated fraudulent income statements made by Chinese borrowers. To mitigate risks they have begun to restrict lending to offshore investors.

- The Chinese Government began cracking down on Money laundering corruption.

Three consequences have been reported in the media.

- Robert Gottliebsen reported in August that “The mass of Chinese property buyers who snapped up Australian apartments “off the plan” on the basis of a 10 per cent deposit have started to walk away from their agreements in Sydney”. Melbourne has larger volumes of Chinese buyers.

- To secure sufficient financial collateral and because banks consider development projects high-risk ventures, developers depend on being able to provide evidence to banks of “off-the-plan” purchases of apartments.

- Risk avoidance by the banks is resulting in restricting or pulling finance on the Chinese markets. This risk means construction became nonviable and added to buyer pull out; it may likely be the greater cause of any given developer may ceasing or stalling development.

While not wanting to “rain” on anyone’s parade, a more likely reason for a drop in construction might be the exit – of what was last year a massive influx of Chinese Buyers. In fact, given the huge influx of Chinese buyers in the market in 2015, it could be hypothesised that Chinese consumers were keeping our economy afloat.

Closing the gates on the wall.

So what hope is there left in the final month of this quarter for us not to discover some time in February that we are in a recession? Because two depressed GDP terms is an official recession and we have less than one month to go of the 2nd term.

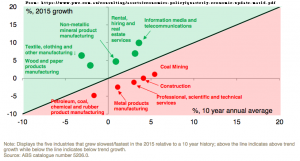

- Manufacturing? – Ford is gone, Holden fired-up the final V6 motor at its Port Melbourne plant on the 29th of November and Toyota is in palliative care expecting to pass away next year.

- Renewable energy market? – The government is slashing support for that industry

- Mining? – Mining investment fell for the twelfth consecutive quarter & the seasonally adjusted estimate fell 0.8%

- Exports? – Exports of goods fell 0.3% which is a bit surprising given how cheap our dollar is.

- Retail? – This is the first decline in over three years as the seasonally adjusted estimate fell 0.8%, so perhaps that is just a glitch.

- Real estate industry services? – which fell by 2.4% which is no surprise – given the continued unaffordability of the housing market.

Industries such as Education, health, power, hospitality, transport, professional & scientific services, etc. contributed virtually nothing. So where are our economic booms?

- Information Media & Telecommunications? – rose 1.6% driven by rises in telecommunications and internet services, so be thankful for Youtube, iView, Netflix and Facebook but it’s a pity we don’t have an innovative & internationally competitive NBN.

- Farming & fishing? – driven by rises in grains, cotton and livestock production it had a 7.5% increase, so the social well-dressed participants at a BBQ with beef burgers may yet save the day.

- Finance & Insurance services? – Up by .1%, so insurance salesmen are still the best sellers around and we are still buying their spiel.

It’s either Jon Snow to the rescue or …

Unless the government can quickly pay off a huge defence “lay-by” as they did last year, it’s in your hands people. Our consistently strong industries have been Retail and Services Industries driven by household expenditures which have been traditionally strong areas of our economy. It’s Christmas, the retail and services industry awaits your patronage if you still have a job that pays a decent wage. You have one month left to buy us out of a recession. Buy up big for your kids, travel and stay in a nice motel. God help Australia, but is our last hope to avoid recession, “Santa Claus“?